A Tale of 2 Christmases

There are two types of retailers in this world - retailers that are highly seasonal for whom Christmas is make or break, and retailers for whom Christmas is just part of the ebb and flow of the year. Regardless of which retailer you represent, Quantiful can help you maximise the opportunity.

Looking at the world very simplistically, most retailers can be divided into two Camps. In Camp 1 are retailers for whom Christmas is ‘everything’. Mid-November to the end of December can deliver up to 40% of annual revenue for these retailers. Get Christmas wrong, and the consequences are somewhere between catastrophic and nuclear.

In Camp 2, we have fewer seasonal retailers. For these businesses, Christmas can be as much a curse as a blessing as it sucks their customers’ spending out of the market and forces them to be reactive. The consequences of getting Christmas ‘wrong’ may not be quite as severe as they are for retailers in Camp 1, but they are meaningful, nonetheless.

For retailers in Camp 1, Christmas planning starts soon after Christmas ends and is largely done by mid-year. For retailers in Camp 2, less exposure to seasonal fluctuations means demand planning is more even and continuous throughout the year.

To bring this tale to life, we will illustrate with two fictitious retailers—one from each Camp. They are, however, based on some of the trading patterns we see within our customer base. For obvious reasons, no numbers are shown in any of the graphs, but the trend lines speak for themselves.

Camp 1 - it’s all about Christmas, stupid.

The biggest risk for seasonal retailers in Camp 1 is running out of hot products at Christmas. Figuring out what will be hot months in advance can be tricky. However, curiously, what people buy each other for Christmas doesn’t change much from year to year and is surprisingly predictable.

If you’re fortunate not to be too constrained by working capital, the simplest way to avoid lost sales is to buy lots of everything and fill your distribution channel with it. The downside of this strategy is you can (and invariably do) end up with obsolete stock you didn’t sell and need to dispose of come January. Christmas is important for retailers in Camp 1, but not to the extent that it leads to mass obsolescence in the new year.

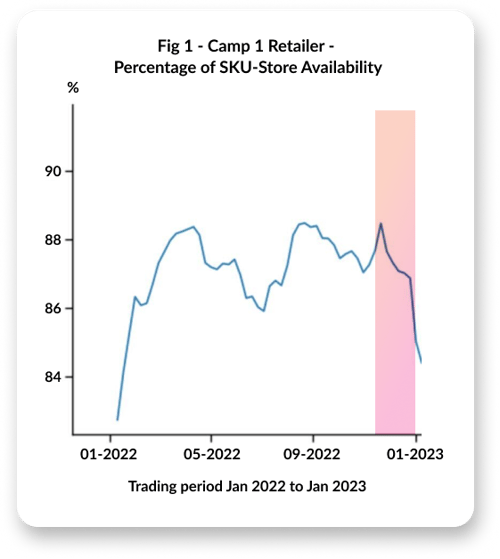

We must look at stock availability over time to judge how well our Camp 1 retailer manages stock levels during Christmas. The graph opposite (Fig 1) shows stock availability up until the point that Quantiful started planning (the red vertical bar highlights the Christmas trading period 2023).

The goal of any retailer is to maintain a >90% stock availability right the way through the seasonal trading period, as any dip is a clear indication of lost sales. As you can see, our retailer typically goes into the peak trading season with high levels of stock availability but comes out of it in a sub-optimal position (80-85%), which means it lost a meaningful amount of sales (as many as 1 in 5).

Figure 1 tells us a lot about the stock the retailer didn’t have, but it doesn’t tell us anything about the stock it did have (but didn’t sell). To understand that, we need to look at stock turnover.

The graph opposite (Fig 2) shows our retailer's stock turnover over the same period, which wasn’t great. They experienced a continual decline in turnover, which means they were overstocked with non-selling inventory, had working capital tied up in obsolete stock, had weeks of cover going up, and had dropping cash conversion cycles—all indicators of a retailer in distress.

Recognising the room for improvement, our Camp 1 retailer implemented Quantiful and fully embraced its planning capability. Quantiful AI handled unsupervised replenishment orders for large portions of the portfolio. Automating the bulk of the process allowed its demand planners to focus on what matters—Christmas!

The shaded area of the graph below (Fig 3) shows the period Quantiful has driven the planning process. Although the graph still shows a dip in availability over Christmas 23/24, the dip was less severe than that at Christmas 22/23 (87% vs 85%). Since Christmas 24, stock availability has become significantly more stable and predictable as the AI has learned more about buying behaviors, successfully maintaining a higher average level of stock availability through the festive trading period.

As we discussed earlier, this outcome can be achieved by buying more of everything, but it would likely result in a continual decline in stock turn—which didn’t happen, as you can see from the graph below (Fig 4)

It took almost a year for the stock turn to come right, which indicates how complex this process is. At the end of 2023, the stock turn graph inverted and started to trend up. With stock turning over faster, there is now less obsolescence and less working capital tied up in stock. The business is now in much better shape, and we expect the trend to continue into the future.

Now, let’s compare the Christmas experiences of our seasonal retailer in Camp 1 with those of our non-seasonal retailer, who has a very different experience

Camp 2 - Location, location, location.

The graph below (Fig 5) charts our Camp 2 retailer’s sales over a similar 30-month period up to mid-2024, when we get involved. You’ll note the long-term decline in sales, which is a pattern familiar to many if not most, retailers regardless of which camp they come from.

You’ll note the minor seasonal bumps in November / December, highlighted in yellow, which show that even non-seasonal businesses can benefit from the increased spending in the market during December (maybe the presents you buy for yourself are the best ones!).

In mid-2024, we got involved with our Camp 2 customers and started to plan for them. As the graph below (Fig 6) shows, we were able to reverse the downward trend in sales relatively quickly and help them maximise revenue (and margin) over the peak trading period.

In time, the predicted sales forecast (dotted line) is expected to be less jagged and show a continuous upward trend in sales (and associated margin), precisely what every retailer wants for Christmas!

As we now know, AI is much better at predicting how much stock a store needs than a human. Simply getting this right will improve sales (by reducing lost sales), but that’s only part of the tale.

Traditionally, Camp 2 retailers have had little choice but to compete with Camp 1 retailers during peak trading periods. Their challenge is to work out how to keep footfall coming through the door when there’s so much other noise in the market. For them, there are three main levers to keep the tills ringing: stock availability, assortment, and promotions.

The problem is that the planning tools and techniques they’ve got (ABCXYZ) don’t take into account the nuances of individual stores.

This results in them running blanket promotions across all stores, which kills margin when they don’t want to or have to!

For example, a Camp 2 store in a dense retail environment will likely have a different Christmas experience than a store with little or no competition. The assortment and discounting strategy must be specific to the store and its local conditions to maximise the overall opportunity.

The power of AI allows retailers in Camp 2 to predict the cannibalisation, substitution, or even the halo effect one decision has on another product line at a store by store level. This allows retailers to maximise the margin opportunity—not just the revenue opportunity—store by store during the busiest times of the year.

With the right data, retailers in Camp 2 can determine precisely what assortment each store should have, how much stock each SKU should carry, and what discounts to offer to maximise gross margin. By optimising our 3 levers at the individual store level, we can significantly impact sales and margin through Christmas and year-round.

Conclusion

Christmas is generally important to all retailers but for subtly different reasons. Whether you are a Camp 1 or Camp 2 retailer, your approach to Christmas can significantly impact your bottom line.

Regardless of which Camp you are in, Quantiful is proven to have a meaningful impact on the outcome.

Call us and speak with the team if you didn’t get what you expected for Christmas. There’s still time to make things right for next Christmas.