5 Key Demand Planning Recommendations for the iPhone 12

The new iPhone range is finally here - What was the initial consumer response and what does this mean for planners looking to forecast in one of the most unpredictable launch years to date?

To answer this, we analysed consumer buying signals coming out of the iPhone 12 launch announcement and from the equivalent iPhone 11 launch in a selection of global markets. Our AI-powered demand planning tool used this data to bring the voice of the customer into an integrated planning process and forecast demand for each of the new iPhone models.

Our team of experts have curated these forecasts and delved deeper into the consumer conversation data to provide some planning guidelines for the run up to Christmas:

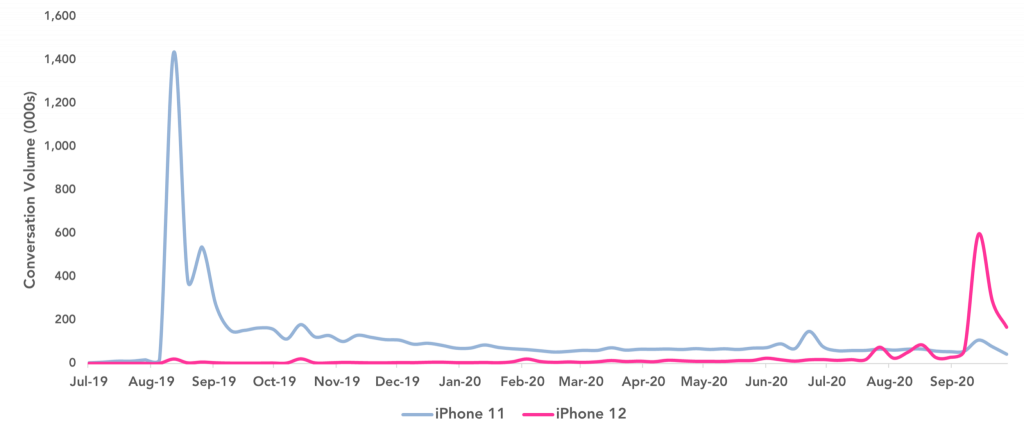

Consumer Conversation Volume for the iPhone 12 Announcement vs the iPhone 11

Overview of new models:

Overall, the iPhone 12 announcement fell short of the conversation volume generated by the iPhone 11 announcement.

The introduction of the new iPhone Mini model and the greater specs/feature difference between the Pro and Pro Max models has meant more choice for consumers.

Unsurprisingly, the iPhone 12 model has been the centre of talk in the majority of initial conversations, however, it’s worth noting volume is down significantly compared to the 11.

While the 12 and 12 Pro models continue to account for the largest share of voice, interest has picked up at the high and low ends of the range for the Pro Max and the mini which have gathered similar levels of conversation volume. The top specs picked up attention for the Pro Max while the mini gained praise for its lower price point and smaller size, even tempting some android users to make the switch to this entry level iPhone.

The iPhone Pro Max is the only model to have maintained a similar level of conversation volume and to have increased share of voice while the iPhone Pro (excluding the Pro Max) saw a drop off in conversation volume paired with commentary indicating consumers are struggling to see a substantial enough difference between the price and specs of the Pro compared to the Pro Max or the cheaper models.

Overview of features:

iPhone 12 Range vs iPhone 11 Range Conversation Share and Volume by Model

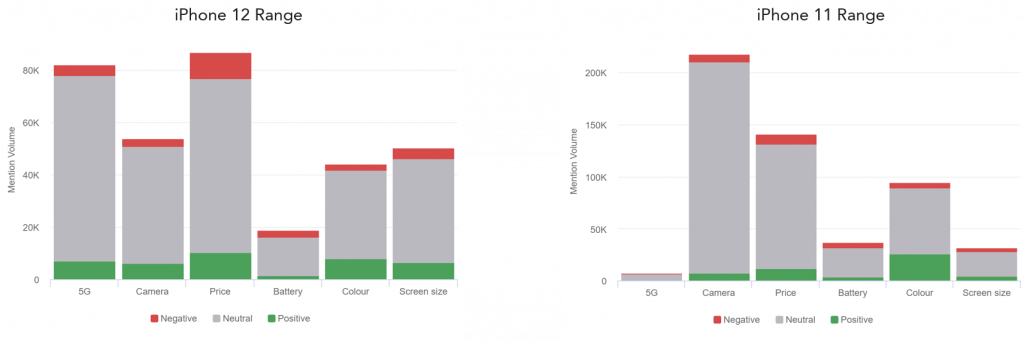

iPhone 12 vs iPhone 11 Sentiment and Volume by Features

Sentiment and volume over the period one week prior to announcement and immediately after.

Price played a far more dominate role in conversations about the 2020 iPhone release, driven mainly by consumers taking to the internet to discuss the box exclusions and the introduction of the iPhone mini at a lower price point. Unsurprisingly given wider economic concerns, increased price sensitivity is evident.

5G and the corresponding increased speed was the focus of the 12 launch and messaging was widely re-shared by consumers across online platforms. While positive overall, 5G has received some negative feedback due to current network or carrier limitations and few other stand out features being introduced this release.

Camera specs (especially when it comes to video) have consumers excited. Size on the other hand has been more divisive, with some left disappointed that they will have to opt for the Pro Max and its large screen size (and price tag) in order to get the best quality camera.

Overview of colours:

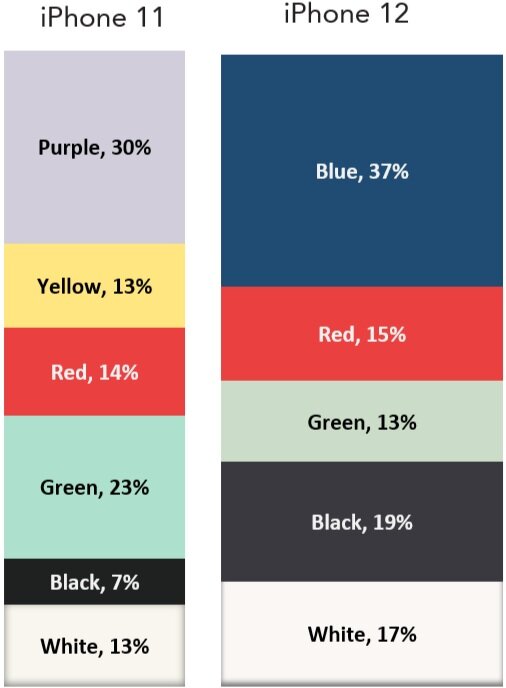

Share of Voice for Flagship Model Colours

When it comes to colour, dark and sleek options have stolen the show in consumer conversations about this year’s announcement.

For iPhone 12 model, the latest shade of Blue has been a crowd favourite, similarly to the purple released in the iPhone 11.

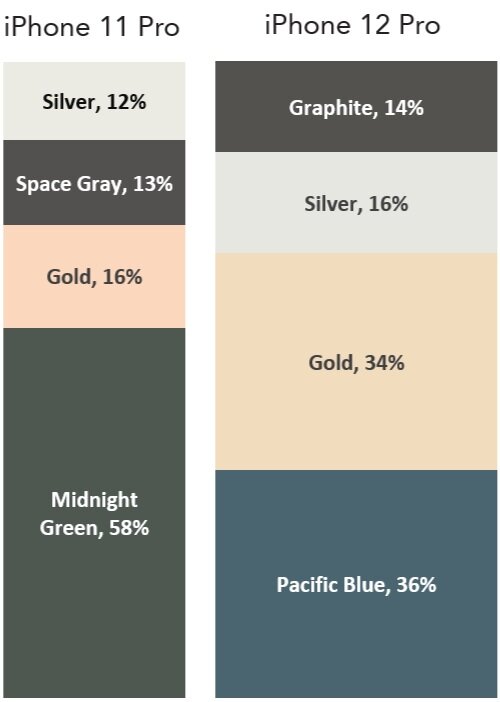

For the iPhone 12 Pro models, Pacific Blue has been popular, followed closely by gold. Pacific Blue was the most commonly mentioned colour for the iPhone 12 Pro Max while Gold took out the top spot for the iPhone 12 Pro.

While the new Pacific Blue has earned less conversation share than the previous Midnight Green, overall conversation for the Blue in the equivalent time period has been more positive.

Share of Voice for Pro & Pro Max Colours

Forecast Implications:

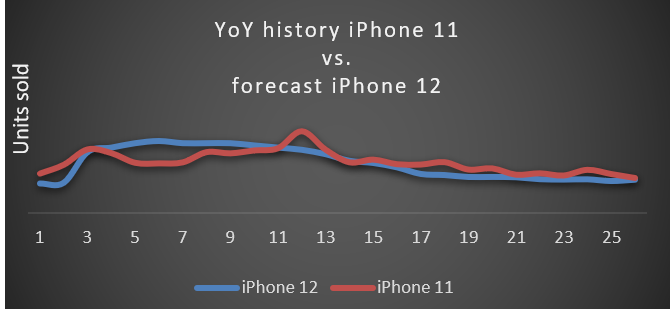

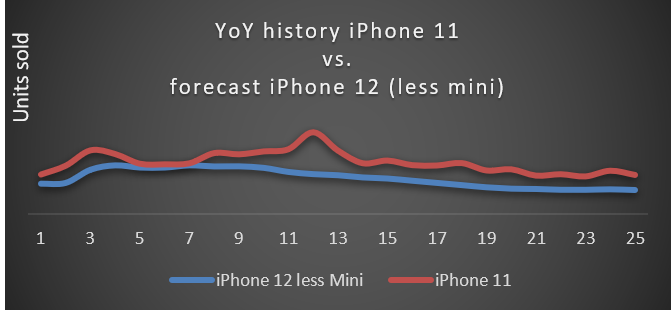

iPhone sales in Australia, New Zealand and selected markets in Southeast Asia.

Source: GFK, IDC and QU forecast

Apple looks to be less constrained on supply this year across a more diverse product range with the introduction of the mini. The interest in the mini has both substituted demand decay YoY for the iPhone and also cannibalised other SKUs. This is largely driven by the new form factor, market positioning and a growing ambivalence to standard sizing and specifications YoY.

In aggregate, iPhone 12 sales look almost comparable to the iPhone 11 range despite the low interest from consumer data.

The three factors to this are:

- Interest in 5G technology

- Relatively clear air from competition like Samsung

- New form factor in the Mini range

Recommendation 1: Range & Supply

- A real-time view on market behaviours will allow you to adjust forecasts, be careful of SKU proliferation with the broadest range launch yet. Understand your geographic distribution footprint in respect of COVID and store access, stay in touch.

Recommendation 2: iPhone 12/Pro/Max/Mini

- Launch with freedom on SKU count, be cautious in the new year where competition and economic uncertainly arrive, plan for a decreased run rate YoY from January.

The purple and green iPhone 11 launches were successful additions and justified further colour expansion on the Apple range in 2020. Looking ahead, the Blue and Pacific Blue, whilst more available across the range, look to invigorate the range and support the growth of sales away from mainstream colours.

The Graphite in the pro range will be a colour of choice in a limited segment with moderate volume at the high end, don’t expect too much.

Recommendation 3: Colours

- Like Apple, be colourful in the first 3–6 months, Apple have invested huge amounts justifying an expanding colour range, leverage Christmas market for the mini, rationalise and settle into a core range in the new year.

Recommendation 4: Competitors

- Enjoy some reasonably clear air at launch and into the new year, be cautious on disruptive competition across Apple and other manufacturers as markets look to liquidate stock in end of Q1 2021.

Recommendation 5: Demand Inertia

- This may be the most stable supply from Apple yet, expect some colour constraints, so look to switch sell to mitigate potential churn. Keep Apple updated with forecast variances.

Thoroughly understanding your customers, what they want, why they want it and ensuring you adapt your planning to satisfy these changing behaviours is more important now than ever. Purchase patterns have been disrupted and last years’ sales history no longer holds the same weight when looked at in isolation. With access to millions of consumer data points, QU uses AI to take these changing consumer behaviours into account resulting in highly accurate forecasts that give you the edge you need to stay ahead of your competition and avoid costly forecasting errors.

Quantiful is already helping many companies in telecommunication and retail sectors to understand their consumers' changing behaviours and to accurately plan, strategise and forecast their future.

Share this

You May Also Like

These Related Stories

Will COVID-19 Influence Demand for Mobile Gaming Devices?

Transform your inventory management system