Why Supply Chain Planning Just Got A Whole Lot More Important

An old adage in business is that the closer you get to your customer, the better you will understand what they really want – but what happens if those customers are constantly changing their position?

In this new world of Covid19, the ‘new normal’ is characterised by a high level of uncertainty and volatility in consumer consideration, intent and buying behaviour, factors which will place a premium on demand planners. Take telco for example. As air freight becomes fraught with difficulty and order lead times for new devices lengthen, more accurate demand forecasting for every SKU will be vital to protect working capital.

What are the implications for mobile operators when planners can no longer rely on a historical view of the world to predict future sales?

We looked at consumer conversations online about mobile, across both New Zealand and Australia, during February and March using QU, our consumer behaviour planning tool.

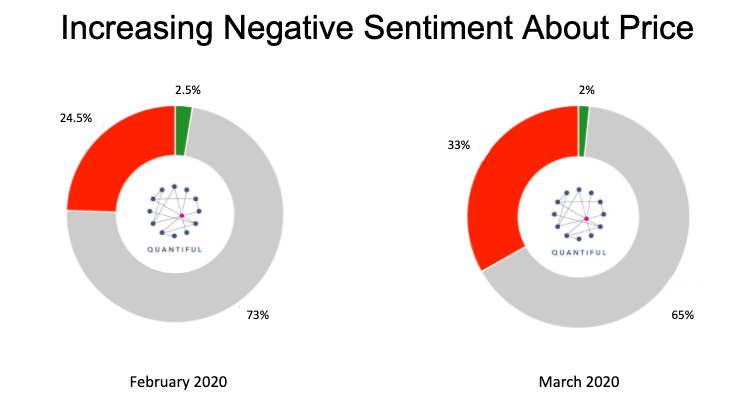

As economic storm clouds gather, consumers are understandably less confident about buying high-end electronics, yet the shift in sentiment is dramatic. Within a few weeks, negative sentiment (red) about the price of mobile devices increased from 24% of conversations in February to 33% in March, while positive (green) remained stable.

At the same time, interest increased in features and accessories that enable people to comfortably work from home while surrounded by family or flatmates, like noise cancelling headphones. For planners this means re-evaluating the premium-priced devices to be ranged, while ensuring sufficient in demand accessories are stocked.

Conversations about contactless payment options also increased during this period as consumers avoided touching surfaces in-store. This has flowed through to pressure on banks to lower fees, or at least allow higher limits, for contactless credit cards and likewise will be reflected in greater demand for devices and watches with the in-built NFC technology enabling contactless payment via Apple Pay and similar.

Consumers are increasingly anxious about where to repair a broken device if stores are closed or difficult to visit, suggesting more opportunities to promote better contactless repair and replacement service options, insurance or even leasing plans that include a full replacement option.

Today you can get closer to your customer than ever before by measuring the behaviours which lead to sales transactions, but you need those insights quickly because traditional planning techniques are just too slow to catch consumers on the move. The good news is that QU is ideally positioned to help demand planners with real-time analytics and robust insights to better inform their decision making.

Share this

You May Also Like

These Related Stories

Why Our New Chief Product Officer is Obsessive About Customers

Quantiful Insights at the AWS Data and Analytics Virtual Series