The World Faces A Shortage Of Premium Protein So What Can New Zealand Exporters Do?

In 2019 African swine flu devastated China’s pork production and it turned to South America and the USA, once tariff wars settled down, for pork and beef to avoid shortages. Now, supply chains in these countries are again in trouble due to COVID-19 shutting down or severely restricting production capacity, putting at risk supply to their domestic markets.

So how have consumers responded to these unprecedented disruptions to supply chains, and what does the future look like for New Zealand exporters of premium food?

Quantiful, whose Saas platform QU uses real time consumer data to track changes in buying behaviour, has been continuously monitoring Chinese and Western markets over the last year for Beef and Lamb NZ and Silver Fern Farms.

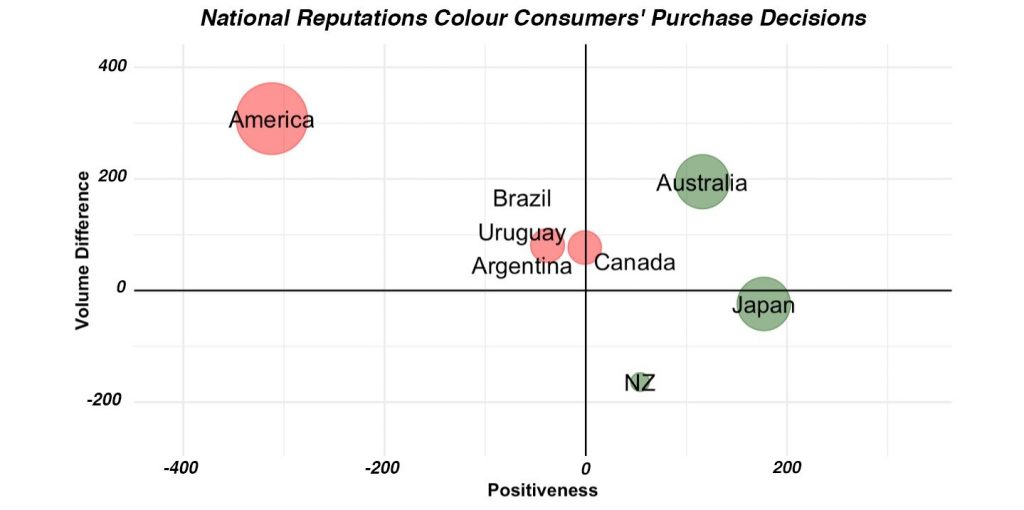

Demand for Kiwi protein surged throughout 2019 as Chinese consumers turned to premium products known for their “purity” and freshness, attributes influenced by perceptions of New Zealand as much as personal experience with the product itself.

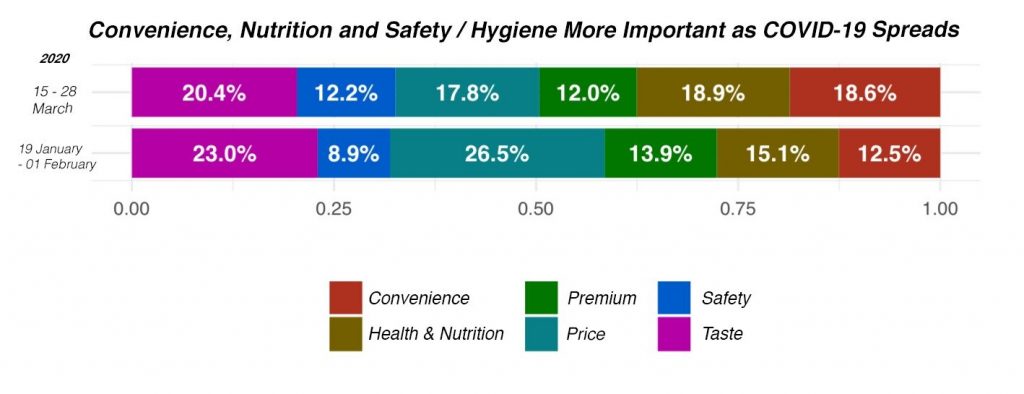

COVID-19 hit in January and purchase drivers among consumers shifted again. Traditional Chinese medicine prescribes consumption of fresh, lean meat to bolster immunity, something reinforced by Government messaging. As Chinese families were forced to cook at home more often, convenience features of both individual cuts and packaging leapt in importance, especially for products purchased online.

COVID-19’s impact in North and South America has also been a major talking point on-line in China, trust in the quality of protein from these markets and beliefs about reliability of supply is changing weekly.

China is now re-opening for business and our tracking indicates a surprisingly rapid return to normal, though high-end restaurants are slower to recover and it’s likely that online will permanently secure a much higher share of retail sales. Against this backdrop, the leading purchase drivers and perceptions are forecast to continue in New Zealand's favour, particularly if this country stays on top of COVID-19.

Armed with this intelligence our clients are quickly adjusting their product and communication strategies to capitalise on emerging opportunities. In particular, brands are upweighting their New Zealand credentials in online messaging and highlighting features which now really resonate, like grass fed. As consumer packaging preferences shift to smaller cuts and multiple serve packs, vacuum packed products in freezer-friendly storage bags are preferred and New Zealand suppliers are looking to upweight supply of these formats. These are perceived to be more hygienic, easy to store and confer a high degree of freshness even when frozen .

A great example of this is at Beef + Lamb New Zealand which uses Quantiful’s insights to keep meat processors abreast of the latest developments around COVID-19 and support their decision making in-market. Hugh Good, Global Market Intelligence and Research Manager, says “this data is as close to real time as we can get and it offers quant level understanding of the magnitude of an issue, with qualitative level nuance and detail.”

Sales, marketing and distribution strategies are adjusting for the new normal, but to meet demand, real time data on changes in consumer buying behaviour must be incorporated into supply chain and operational planning. Only then can premium New Zealand food exporters be confident they are well positioned to take advantage of the rapidly unfolding trends in consumer buying behaviour.

Share this

You May Also Like

These Related Stories

Why Our New Chief Product Officer is Obsessive About Customers

Analyse your supply chain